best forex brokers in usa

It https://top10best.io/ is no secret that a good number of international Forex brokers have regulations that restrict US traders. A good number of international Forex brokers operating offshore do not accept US residents to open account with them. A good number of these brokers are the regulated ones. The reason for this will become very clear as we tackle every reason. There are strict regulations that limits doing business with US citizens. Most of these regulations originate from the US government. Fortunately, these regulations do not completely stop international brokers from accepting us citizens. There are a good number of offshore international Forex brokers that accept US citizens. Below is the primary reason why some offshore international Forex brokers do not accept US citizens.

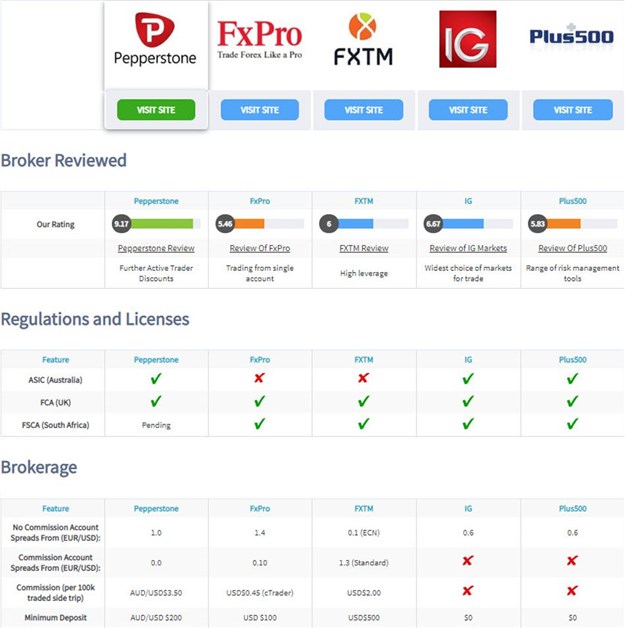

From there the investment mechanics is very simple.If you think that the dollar is going to gain value with respect to the euro you will have to buy dollars, while if you think you are going to lose it you will have to sell it.Therefore, in the forex market there is not really the concept of a bull or bear market, since one currency always goes up or down with respect to another, so the movements will always be inverse.In thisway there will always be good investment opportunities in the market, regardless of the time of the economic cycle.Of course, the crux of the matter is knowing how to identify trends, in order to take advantage of them.Always keep in mind that, when investing in currencies, volatility is quite high and the forex also refers to leveraged products.The investment in forex is tremendously interesting, both for the vibrant variations and for the great returns that can be obtained.However, the excitement should be restricted to the investment itself, and there should never be uncertainty about whether the broker is going to refund your money or not.Therefore,one must be careful with the fraudulent web pagesthat appear every day on the hunt for trusted investors.Making a good analysisof the security and offer of the broker is the basis for making a good decision.Therefore, in Ubanker we have carried out reviews and in-depth analysis of a large number of brokers.In the table at the top of this page you havethe best FX brokersand in the right column you can see all the reviews available.

By law, Forex regulatory bodies require that Forex brokerage companies maintain segregated accounts. The law stipulates that all clients funds are deposited in segregated accounts. The segregated accounts are constantly monitored by the Forex regulatory body controlling the brokerage firm. The intention is to prevent the clients account from any act of criminal or fraudster activity.Forex brokers are your gateway to the Forex market. The vast majority of traders in the market access it through a traditional Forex broker. While there are some quality brokers out there, many people have mistakenly chosen scam brokerages to open an account with at some point. If you are interested in finding the right broker, here are a few things for you to consider.As withbinary optionsandCFDs,investment in currencies is very attractive due to thegreat potential for profitability.No doubt a high potential return has a high risk associated, but forex investors continue to increase, because the risk can be easily managed with stops, diversification and good pre-investment analysis.

It is very possible for any Forex broker to become insolvent and bankrupt. There is no exception to this as it can happen to any Forex broker. During insolvency, the broker is barred from using clients funds to pay off its creditors or finance its expenses because it is separated recognized as belonging to clients. The clients funds are henceforth tied up in litigation during these hard financial times for certain duration.Forex is a complicated market and I have realized that many traders try to find the best brokers. But it is hard to decide because it is about where you live actually. Traders from US/UK will be served well with these brokers but to whoever from Asian or Africa, Cyprus is a better choice. The reason is that it provides traders with low cost of spread or commission but high leverage and good payment system or trading platform.

However, top ECN brokers have a brilliant solution for this problem. They know that liquidity providers are thought to be more reputable and give more stable quotes. Actually, these big providers give the quotes by themselves and that are even more risky and unstable. ECN brokers like Exness or FxPro choose to combine all the quotes from liquidity providers then supply for traders so that if there are any accidents they can have more choices and alternative quotes. That means there will be no higher slippages, no-quote errors or gaps. That is excellent.Before choosing a Forex broker, it is important to weigh all of the factors involved in the process. There is no perfect broker in the Forex market, but you can find some very good ones. You need to decide which factors are non-negotiable and which ones you might be willing to bend on. Once you look at all the factors, you can open an account and get started making money.

The regulation is an important part in forex market, which can show the standards, capabilities and reputation of a broker. However, it is not the most important part that we should only focus on. Some traders just consider about the number of forex certificate of a broker but dont know the fact that one trusted license is enough. A broker doesnt have to obtain more regulations, which makes more requirements and limits to them. If a country that it serves already has a regulation, then one regulation is good enough for that broker. These are good licenses in the market ASIC, CySEC, FSA, CFTC, NFA, NFA.The top 10 ECN brokers have been run for a long time ago and there are no summary for the scams. They are transparent and have everything shown on the website. But, beginners sometimes can be confusing about the problems about stop loss. They may concern about this because they do not understand clearly about buying and selling position when trading.

It is said that brokers of US, UK and Japan could not have high leverage because of their regulations in their countries. Therefore, they are less competitive than other brokers since most traders prefer high leverage. Following are brokers with the highest leverage.When choosing a broker, it is important to find out where they are located and who they are regulated by. For example, if you are checking out a broker in the United States, they will be regulated by the National Futures Association. You can then get on the NFA website and see the broker's customer service history.Currency names were standardized usingISO 4217so that a currency is expressed in three capital letters, the first two letters being the beginning of the name of the country and the third letter being the first letter of the name of the currency.Thus, for example, JPY is the name of the Japanese yen and USD the name of the US dollar.The payment systems of US or UK are great. But that is when they serve the local clients. If you are from other areas you have to pay more to make sure your investments are safe and secured. Traders need brokers that can serve them economically and effectively. Payment systems should be placed at the locals so traders can transact easily. Exness is one of the brokers that have the payments systems perfectly built. They have payment service in most of the countries that they have traders in. So the transferring will not take hours or days but just minutes or seconds in order to withdraw the money. Moreover, Exness minimum deposit is just as low as.